Top Holly Springs Lendor Gives Credit Score Requirements for a Mortgage

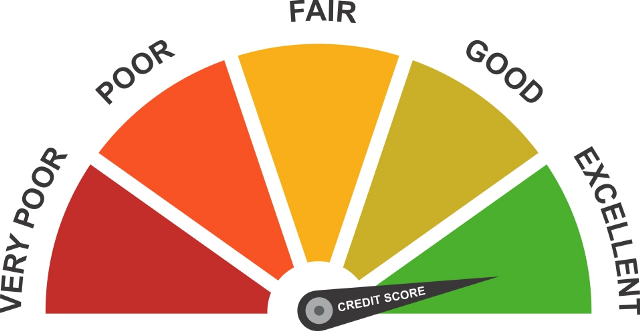

Potential Home Buyers ask us every day, “How can I improve my credit score???” There’s not a simple answer, because every credit history (and score attached to that history) is like a snowflake. Credit Score Requirements for a mortgage are different based upon the kind of mortgage you are looking for.

In general, you will need a credit score of at least 600 for an FHA loan, and 620 for a VA Loan. Conventional Loans usually require a minimum credit score of 660 – but credit scores over 720 will get the best pricing (today’s best mortgage rates).

For a USDA Home Loan you will generally require a score of at least 640, anyone UNDER a 680 score must meet all guidelines, perfectly.

If you are close to these Credit Score Requirements for a mortgage when you are looking at your “Credit Score Numbers,” or if you qualify for a NCHFA program, (which requires two scores over 640), you are probably CLOSE to being able to buy a house in North Carolina!

The NC Housing Finance Agency is much easier, right now, to qualify for than a USDA Home Loan! If you qualify for the NCHFA program, you can get the down payment and potentially closing cost, in the form of Down Payment Assistance.

Ready to buy a house??? We want to help! CALL US! 919 649 5058, it doesn’t cost ANYTHING to get our opinion of what you need to do next!

There are some concepts that are important to understand about Credit Score Requirements for a mortgage / Minimum Credit Scores and ways you can go about improving your credit score – no matter what loan program you are applying for:

- Late Payments Showing on Report: If your report shows one or two late payments over a LONG period of time (probably more than 8 months ago). Call the Customer Service Line and ask very nicely for it to be removed.If the Customer Service Rep does not have the authority to remove the items (which they normally do not), ask for a supervisor.

Be nice, beg, beg, and beg some more! It really is important to have any documentation available to show the company that it was a simple mistake (like put the wrong payment in the wrong envelope when paying bills one month – I’ve done that before but you need the evidence of the check returned and the letter from the other company).

If you were honestly late on payments, there is NO REASON to dispute the late payments. This approach does not work and could make your credit scores go DOWN.

- High Balances on Credit Cards: Look on your report for the balance between your Credit Limit and your Current Balance. If you have high balances on some cards but low ones on others, spread the balances around. If you a shopping for a home – and need to elevate your scores – REMEMBER that most credit cards companies only report to the bureaus once per month. This means that if you move balances around on the 15th of the month – it could take more than 45 days for the difference to reflect in your scores.

- Having ALL student Loans, or Car Loans (installment debt) and no Revolving Accounts. If you do not have credit cards and cannot be added to a family members account as an authorized user – you need to get a couple of Secured Credit Cards. You can get them from the Bank at Wal-Mart. Not sure about Secured Credit Cards? Call us at 919 649 5058, we can help.

- Closing Credit Card Accounts:The “old wives’ tale” is that people should close old accounts, especially if you have a zero balance and no longer use the account. If you are an Impulsive Shopper – I can see the reasoning in this train of thought. However, you never want to lose years of a good payment history by closing a card you are no longer using. “In fact, if you haven’t used them for a couple of years, they may have gone “stale” in the scoring model. I say charge a tank of gas and pay it off when the bill comes to re-age them into the most recent scoring models.”

Remember that Credit Reports are Unique, and they cannot be changed in a matter of a couple of weeks. If you are considering a home purchase this year, call us NOW so that we can help you get your scores up! IT WILL SAVE YOU TENS OF THOUSANDS OF DOLLARS!

Credit Score Requirements for a Mortgage

Conventional Mortgage Loans with less than 20 percent down payment require Mortgage Insurance. That’s an added layer of Underwriting. We do a ton of Conventional Mortgage Loans, mostly because of the fact Fannie Mae does not count variable payment Student Loan Debt in qualifying. The PMI models are looking for a credit score over 720 – however, we can get PMI as low as 640. It’s just very expensive.

FHA Mortgage Loans can have scores as low as 620, and the down payment can be a gift. Unlike VA loans, FHA Loans do not require that the borrowers be married!! FHA counts ½ a percent of the balance for Student Loans, if those loans are on a variable payment schedule, like IBR.

VA loans have credit score requirements that might make it easy to buy a home in NC too! Currently, the automated underwriting engines are looking positively on scores over 620. Although it is a little complicated, VA Home Loan Underwriters do not count student loans that are in deferment. If you are using Veteran Benefits and have Student Loans, call us to find out how that could impact your qualifying power.

USDA Home Loans generally require two scores of 640 to 680. Every county in NC has a portion that currently qualifies for USDA Home Loans, but those “boundary maps” will change again in December of 2020. In Raleigh, for instance, about 25 neighborhoods will no longer qualify for the program, however – EVERYWHERE in Johnston County qualifies for the program. USDA Home Loan Underwriters count ½ a percent of the balance for Student Loans, if those loans are on a variable payment schedule, like IBR.

Want to know specifics about the Credit Score Requirements for a Mortgage and YOUR Credit Score? We can run a simulator, and let you know what you will need to do to quickly raise your credit scores, with NO COST. Call US! Steve Thorne, 919 649 5058 NMLS 60596

Equity Resources, Inc. NMLS 1579, NC L-134393-102

201 Shannon Oaks Circle, Suite 204, Cary NC 27511